A PROPOSAL FOR SOVEREIGN-BACKED FX DIGITAL CURRENCIES

A primary role of Central Banks is managing the value of their local currencies. Depending on the specific dynamics of the economy, the Bank might be interested in strengthening,...

Filter by Category

A primary role of Central Banks is managing the value of their local currencies. Depending on the specific dynamics of the economy, the Bank might be interested in strengthening,...

It is easy to conclude that certain countries or their nationals are intrinsically corrupt. After all, the word “corruption” has become meaningless to most Nigerians...

I’m still reeling from the circumstances leading to the #EndSARS protests and all the unfortunate developments since. The protests have been followed by reports of intimidation,...

Almost in cycles, there’s always a conversation on Twitter about sports betting. The most recent is one by a person who lost £447,880 over 12 years. These conversations are...

A long time ago, Martin Seligman, an American Psychologist, conducted a very interesting experiment. I’ll describe a simplified version: Two groups of dogs were placed in...

Nigeria did not play to its unique advantages, paid a needless economic price in the short term, and will continue to pay in the medium term.

The soundness of deflationary crypto-token economics is yet to be tested, but it sure has promise.

I know. It’s not a good time to use “Nigeria” and ‘scam’ in the same sentence, but it’s gotten too close to home and I think it’s worth talking about. I’m a very vocal promoter of...

I’ve been very reflective lately. It’s been a bit over 5 years since I got into this tech entrepreneurship thing, and recently, I’ve had the headspace to think about how I got...

In February, I observed the Nigerian presidential and governorship election week from Bangladesh. Bordering India and Myanmar, Bangladesh is the world’s eight most populous and...

A primary role of Central Banks is managing the value of their local currencies. Depending on the specific dynamics of the economy, the Bank might be interested in strengthening, weakening, or maintaining the exchange rate of the local currency against foreign pairs. Although there are several external factors in play that influence relative currency values, Central Banks try to achieve their objectives by engineering the currency demand and supply drivers throughout the economy. For example, demand for local currency can be stimulated through measures that boost local production for consumption and exports. Other major tools are interest rates to stimulate local savings and lending, or government spending and borrowing.

Nonetheless, developing market currencies are historically depreciating currencies. This can be a major problem as it consistently increases the cost of external debt and inflates the prices of imported goods, including manufacturing inputs. The purchasing power and quality of life in these markets, therefore, tend to erode along with the weakening currency over time. Consequently, to preserve the long-term value of their capital, holders of the local currency pre-emptively fly to safety by purchasing and saving historically stronger and stable currencies like the US Dollars; Speculative demand for stronger and more stable currencies like the USD is high in these markets. In many cases, under worsening economic conditions, the USD becomes scarce due to reduced diaspora remittances or dwindling export revenue, forcing speculators to purchase US Dollars by proxy using cryptocurrency representations instead—mostly USD stablecoins.

The purchase of USD (or USD stablecoins) as a capital preservation measure is a bet against the local currency. It is also a self-fulfilling prophecy. For any tradable asset, a sale contributes to downward price pressure; therefore, in betting that the USD will strengthen against the local currency, speculators are exerting a force that contributes towards that outcome. As the downward pressure manifests, more speculators see the trend as validation of the thesis and follow, so the weakening of the local currency becomes self-perpetuating. To counteract this, the Central Bank often intervenes and supplies USD into the system from its reserves to match the increased demand. This tends to be unsustainable long-term.

Central Bank Stablecoins

A Central Bank could implement a mechanism that enables speculators to place their bets without influencing the odds. Consider a sovereign-backed stablecoin, xUSD, that is valued at 1:1 against the Dollar. It can be purchased with the local currency at the present official Dollar rate and redeemed for the local currency anytime at the future official Dollar rate. In doing this, the Central Bank is taking the other side of the bet in favor of the local currency. If the local currency indeed weakens, the Central Bank will have to redeem xUSD for more local currency than it was purchased with, and if it strengthens, they redeem for less.

xUSD is not a Central Bank Digital Currency (CBDC) in the way it has traditionally been defined. CBDCs are blockchain-based equivalents of the local currency and the long-term implication of CBDCs on economic activity and monetary policy is yet to be understood. xUSD would simply be a sovereign-issued FX stablecoin. There are several privately-issued USD stablecoins in the market, and the integrity of those assets has been called into question. After years of pressure, the Tether Foundation recently committed to more transparency around the touted backing of the popular USDT stablecoin and released their first attestation of reserves. A sovereign-issued stablecoin is innovative and attractive in the sense that, just like its treasury bills, it is backed by the full faith and resources of the issuing government (including its FX reserves, but mostly for the optics as it can only be redeemed for local currency under this proposal), and it does not require physical counter-asset backing. By buying xUSD, Dollar speculators in developing markets who are simply seeking to preserve their local currency-denominated wealth can achieve their intended outcome without placing real demand pressure on Dollars at the expense of the local currency.

There is a risk that the issuing government could artificially peg the official exchange rate low at the point of redemption. This is unlikely as Central Banks generally prefer exchange rate convergence in the market to wild spreads between quoted official rates and parallel market rates. Aggressive currency depreciation in the parallel market will likely see official rates depreciate as well, and since the original purchase price of the xUSD would have been at the official rate, the return profile would be close to the depreciation rate.

Cross-Border Transfers

A less experimental implementation of the xUSD is for cross-border transfers. The international banking and settlement systems are currently set up in a way that value is eroded from the transaction flow in favor of Western banks. A USD bank wire transfer from Ghana to Kenya today will likely see the funds first routed through an American or European intermediary bank before settlement into a domiciliary account in Kenya. Throughout the transfer flow, wire fees are deducted and snail speeds are forced on the transacting parties. If the Central Banks in two developing countries—Country A and Country B— collaborate to issue a Dollar stablecoin, parties in both countries can bypass the intermediary banking system. Senders in Country A can purchase xUSD and send for onward conversion to a recipient in Country B.

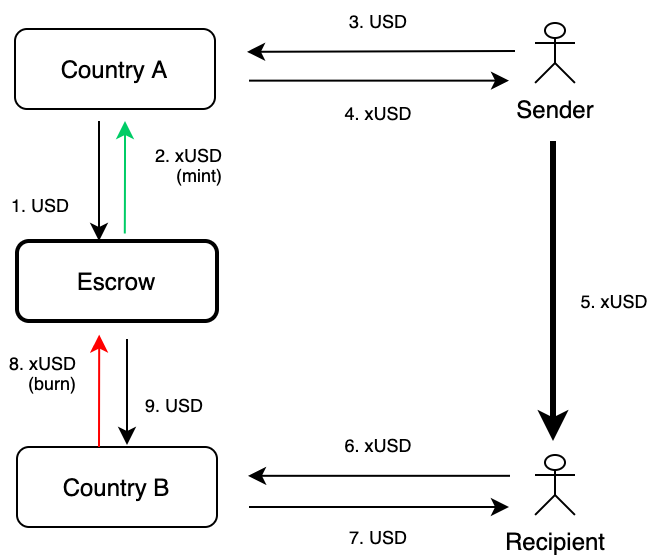

For cross-border transfers, the xUSD merely functions as a transmitting system. However, for this particular use case, xUSD would require real USD backing by the issuing countries; Country B’s Central Bank holding xUSD must be able to redeem it from Country X (or preferably an escrow institution) for USD. The flow would be as shown in the diagram below:

The physical backing of the stablecoin with USD and redeemability for USD, in this case, is important to create an incentive to adopt the system because the receiving country would eventually require the actual USD inflow to participate in global trade outside the network. Country A and B would need to coordinate and create a central agency where they deposit USD or liquid USD-denominated assets that fully back any Dollar stablecoin minted, and this agency becomes the central intermediary bank. Nonetheless, as users’ trust in the redeemability of xUSD for USD strengthens, the stablecoin will likely eventually be as good as USD to hold, resulting in reduced xUSD-to-USD redemptions. xUSD simply circulates back and forth, and markets for local currency to xUSD exchange will emerge, leaving a significant amount of USD static at the escrow institution’s position that can be lent out to participating countries fractionally or safely invested for yield.

A Model Use-case for Blockchain

The blockchain is synonymous with decentralization, but distributed ledgers can also be the perfect technology for semi-centralized solutions like this. By issuing the stablecoin digital asset on the blockchain, the Central Bank can avoid the complexities that would manifest with a private ledger. The blockchain enables ownership assignment via mere custody, which means that xUSD can be transferred between parties without counterparties requiring some sort of bank account. By issuing xUSD as a crypto-asset, the National Banks avoid having to create a special type of account system that will inevitably have cumbersome restrictions around external transfers. The mobility of the blockchain enables it to develop real-world utility, for example, as a remittance instrument if it is listed on international digital asset exchanges. By having access to the local currency on-ramp and off-ramps, persons of interest can also be monitored against money laundering without having to subject each lifetime holder of the xUSD to KYC and AML requirements, just as physical cash deanonymizes once it hits the banking system. Finally, the blockchain ensures publicly-verifiable transparency around the “minting” and “burning” of xUSD, so the public can verify exactly how much is being created and destroyed real time.

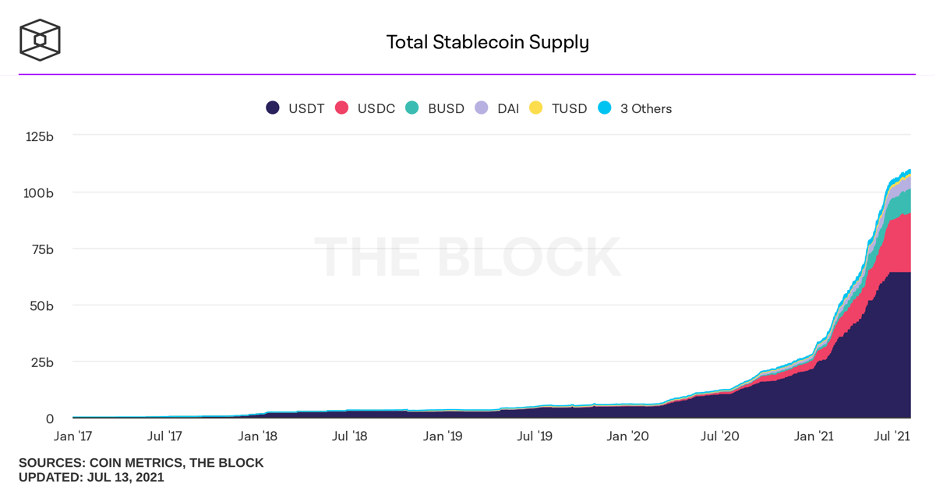

Stablecoins have gained indisputable utility in the crypto space, facilitating billions of Dollars in daily transactions. Stablecoin supply has already exceeded $100bn.

The peg on the assets with the largest market capitalization (USDT, USDC, BUSD, etc.) has been upheld by the integrity of algorithms, or users’ fragile trust in private entities like Binance and Circle to maintain equivalent reserves. However, governments already have trust by default as currency issuers, making them the most ideal issuers of FX stablecoins. More so, the race and pressure to issue local currency CBDCs to compete with private crypto-assets might be futile, as local currency CBDCs might only have the effect of digitizing existing financial silos: CBDCs will simply weaken the deposit-taking usefulness of retail banks, and do little to facilitate global value transfers without relying on third-party, private, exchange platforms for liquidity provision. Perhaps, institutions like the World Bank, the Bank of International Settlements, or the United Nations can live up to their names and function as the central institution for managing collateral deposited by countries for the creation of a global and mobile, transactional stable cryptocurrency.

Absent the motivation for the international coordination described above, countries can simply issue FX stablecoins backed by “the full faith of the government” to allow for internal speculators with local currency to purchase a USD tracker-asset redeemable for the local currency at the prevailing rate, without actually purchasing real USD and putting negative pressure on local currencies.

Be notified when a new post is up!

Comments