Deflationary Tokenomics – All About Alpha

The soundness of deflationary crypto-token economics is yet to be tested, but it sure has promise.

Since SureRemit announced a modified utility model for the RMT token, I’ve been attempting to visualize exactly how a deflationary token economic model would work (thanks to isolation-induced psychosis). SureRemit has a fixed supply of crypto-tokens, and following an Initial Coin Offering where these tokens were distributed to buyers, the original incentive mechanism for token-holders relied on an expansion of demand which must exceed the supply made available by existing token-holders for positive price action. I have since discovered that there’s an agency problem inherent in this model for certain types of utility tokens, where certain market conditions will nearly guarantee negative price development (I will publish a paper on this soon).

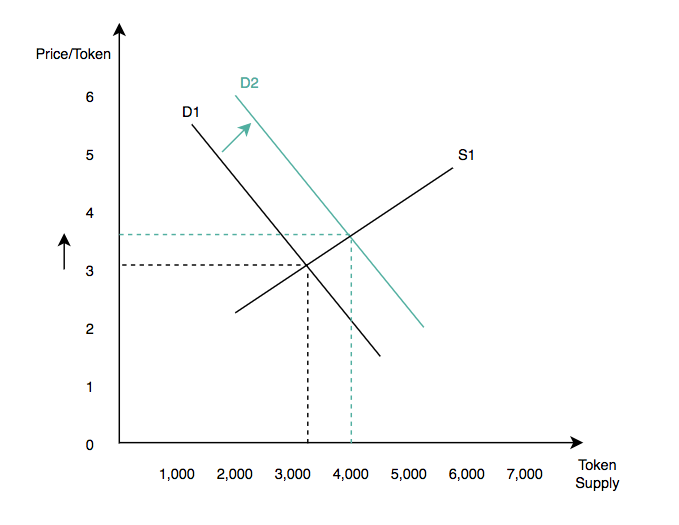

The basic graph below illustrates how the RMT model was originally imagined. The platform was to generate new demand (shift of the demand line to the right), and this should influence price positively, which in turn triggers token-holders to supply and match the new demand at a price higher than the previous equilibrium.

A flaw in the model is that the company must re-circulate the tokens demanded via its platform, which means that it contributes to the extra supply of tokens in the market, canceling out the price appreciation from the demand (D1 to D2). More importantly, Speculative goods in a bear market create an exception to the law of supply: The lower the price, the higher the number of tokens supplied (flight to safety). To escape this phenomenon, demand for tokens must trend upwards consistently at a higher degree than the company needs to recirculate them, and the effect of that on price has to be strong enough to reverse the violation of the law of supply for speculative goods in a bear market.

From the model described above, it is clear that the company is participating positively on the demand side of the market, but negatively on the supply side. A new model was necessary to ensure that the activities of the company reflect positively on both sides of the market.

Token supply deflation is a mechanism that ensures that the company can generate demand for tokens in the market, and reduce supply at the same time. This means that rather than accepting RMT as a payment token on the platform (which needs to be recirculated), RMT will instead be accepted as fees which will be burned. To illustrate, if the company makes $200,000 in sales and charges 1% as fees in RMT, $2,000 worth of RMT will need to be purchased from the market (demand) and eventually burned; i.e, permanently taken out of circulation/stock of supply.

I wanted to visualize the extent to which this model will affect price development, and I developed a simple model with fictitious figures. You can edit the text in blue on the Google Sheet from the link.

Token Supply: Total number of tokens circulating

Burned Tokens: Total amount of tokens burned

USD: Dollar value of tokens burned (1% of company sales)

% Burned: Percentage of total supply burned

Book Price: Effective price of tokens with zero market action; i.e, the price per token if tokens were bought exactly at previous price and there is no additional buying or selling in the market

Book Return: Effective return from a reduced token supply

Book Cap: Total book value/capitalization of all tokens in circulation (remains constant)

ER + Alpha: Expected return plus Alpha*

Market Price: Marke Price of tokens based on the return from reduced token supply & the Alpha

Market Return: Implied market return on the tokens

Market Cap: Total market value/capitalization of all tokens in circulation (influenced by Alpha)

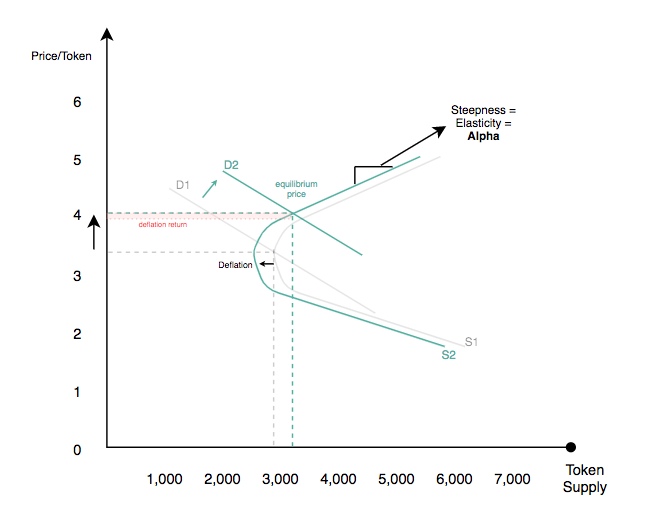

I define Alpha as the impact on price from a one-unit order. That is, to what degree is the price of a token expected to appreciate/depreciate following an order to buy/sell a unit of the token? If an order for 1% of circulating supply results in a 100% appreciation in price, then the token has a 2x Alpha (for the model, I assume that buying 1% of supply has the same relative effect as buying 0.5%, i.e., if buying up 1% of supply should impact the price by 100%, then buying 0.5% should impact the price by 50%).

Based on the model above, for a token with a 2x Alpha and a market capitalization of $500,000, buying and burning $2,000 in tokens and growing that amount by 5% month-over-month should result in a 17.54x return over two years.

The Alpha is not influenced by the company. The actions of the company (burning of tokens) only directly influence the left side of the model, and the returns from burning tokens are only marginal to the total market return because of the Alpha. The lower the Alpha, the lower the market price of the tokens, the higher the number of tokens that can be purchased burned, the higher the book returns, but the lower the market returns.

A higher Alpha is obviously better for token holders, but what a deflationary model like this ensures is that the number is entirely a function of the net cumulative actions of token holders. There is a clear ‘Chinese wall’ between the business activities of the company and the speculative activities of token holders.

Indeed, to be a little more theoretical, the Alpha measures two things:

Therefore, the real supply line is convex-shaped. The company is responsible for driving some of the shift in the demand line, but the full extent to which the demand line will shift depends on the speculative market. Also, the company is responsible for a shift in the convex supply curve to the left via deflation for a small return.

In general, I’m looking forward to gathering more data on deflationary tokenomics. Hopefully, at some point in the future, the industry will have enough depth to develop better predictive models for crypto-assets.

Be notified when a new post is up!

Comments

great read samuel thanks