Nigerian Banks and the Fear of the (un)known

The only way cryptocurrencies will threaten the legacy financial system is if they remain and thrive outside of it.

Filter by Category

The only way cryptocurrencies will threaten the legacy financial system is if they remain and thrive outside of it.

We didn't expect our lives to change immediately, but we expected ordinary miracles. A miracle, in Nigerian terms, would simply be to do something right.

If Harvard admitted students based on the applicant scoring in the top decile of test scores + HS performance, they'll barely admit black people.

My objective is to relentlessly grow our brand to be the biggest non-cash value transfer platform in Nigeria and Africa at large.

Across the world, there are hundreds of millions of immigrants and travelers like me that need to transfer some immediate, non-cash value internationally, but the systems that have been set up to facilitate that don’t take into account the nature of transfers.

My answer here: There are 1.2 billion people in Africa. There will be 2.4 billion by 2050 and that’ll be a quarter of the world’s population. Over the next few decades, not many...

Until we care and the nation stands still because of one death and one kidnapping, male or female, young or old, 276--or the more twitter-friendly 234--is just a number.

We all know the fair value of a good Developer, Designer or Accountant, but what’s the going rate of a Founder? (written in April 2014)

Examining and defining your motives as an entrepreneur will create a clearer path for your venture and reduce fatigue and frustration. (written in March 2014)

A while ago, I promised a review of all three of Chimamanda Ngozi Adichie’s books. All were as brilliant as I expected (written in 2010).

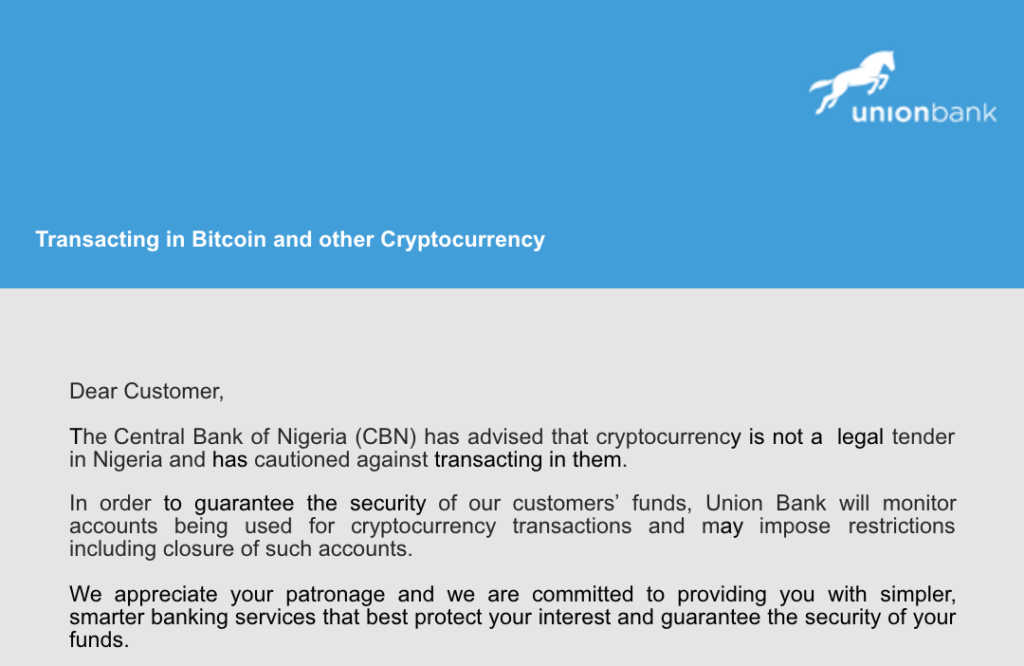

Today, another bank in Nigeria distributed an anti-crypto e-mail to its customers. This one was a bit different, though. For the first time, I think, the bank threatened to impose restrictions on accounts discovered to be transacting in cryptocurrencies, including the “closure of such accounts”. The bank rationalized the decision by stating that “the Central Bank of Nigeria (CBN) has advised that cryptocurrency is not a legal tender in Nigeria and has cautioned against transacting in them.”

I found this a bit funny. The USD is not legal tender either. In fact, the Central Bank, in this press release, also advised that foreign currencies are not legal tender in Nigeria and cautioned against transacting in them. Yet, your account is not at risk if you buy or sell foreign currencies, and the banks even hope that they can be the intermediary for your forex transactions. This defeats the “legal tender” argument.

The newsletter went further to state that these account restrictions will be imposed “in order to guarantee the security of our customers’ funds”. That’s rich. You can buy literally anything with your money: alcohol, cigarettes, Bet9ja ticket with 13:1 odds against Arsenal, church tithes, foreign currency, treasury bills… anything, but the bank will like to guarantee the security of your funds by making sure you’re not able to buy or sell cryptocurrencies because they have special account-depleting attributes. Makes no sense to me.

Cryptocurrencies, like the USD, or seashells, might not be legal tender in Nigeria, but they’re not illegal properties. While banks have the right to terminate its relationship with any category of customers for any reason, they should really evaluate and be honest with their motivations. The people who understand or hold cryptocurrencies have a clue, but the banks need to do a self-assessment and come up with sincere reasons themselves because it certainly isn’t coming from their concern for the integrity of their customers’ bank balances. The deposits in the vaults are not even guaranteed beyond the N500,000 (±$1,400) covered by the deposit insurance scheme.

The Nigerian Naira doesn’t lose value against itself (theoretically), that’s why 1 Naira remained 1 Naira even though it lost half its value against the USD during the last election cycle. Likewise, 1 Bitcoin is 1 Bitcoin, and 1 gold bar is 1 gold bar, regardless of what they convert to in USD at any point in time. It is possible to record a loss if you purchase the Naira (forex trader), Bitcoin (crypto trader) or Gold (commodity traders) as an investment instrument, and every adult is within their rights to assess their individual risk profile and make investment decisions. Irrespective, my guess is that most Nigerians are not buying or selling cryptocurrencies as investments.

For institutions with such incredible resources, I’m always surprised about how little they understand of the emerging industry. The technology encourages extremely convenient peer-to-peer transacting. This means that if players are aggressively excluded from the banking system, the peer-to-peer (or shadow/black) market will simply thrive more easily. This is good for cryptocurrencies as a whole in the long term, but it’s unfortunate for both the banks and regulatory authorities: The banks will lose an opportunity to capture a bit of the value from the growing trading volumes, and the authorities will find it even more difficult to measure and follow the flow of funds. This phenomenon can be observed whenever there’s a major lack of supply of (or embargo on) forex at the banks, which increases trading activity on the streets.

I’m sure the regulators also understand how difficult it is to tame an active peer-to-peer market based on recent experiences with Ponzi schemes like MMM in Nigeria. The wise thing to do will be to encourage transactions within the system so that existing KYC/AML monitoring systems at the bank account level can simply be extended to crypto transactions. People won’t stop transacting; however, banks and regulators can choose whether or not they want to know who is transacting, what they’re moving and possibly where, by encouraging platform-based transactions, versus P2P.

Nigeria is one of the most active markets in the world for cryptocurrency transactions for many reasons. By virtue of nationality alone, Nigerians are excluded from participating in the global economy at any meaningful level. Try sending $5,000 from the US to Ibadan in 12 hours as a Nigerian. An average person still struggles to pay and be paid internationally and we bear some of the highest costs and scrutiny in the world for whatever transactions we manage to successfully execute. Through the miracle of technology, cryptocurrency wallet addresses are not assigned nationalities, and the implication of that alone is that crypto will continue to thrive in markets like Nigeria.

Banks and authorities need to understand that participants in the cryptocurrency space are not under any illusion that it’s “legal tender”. They understand that it is simply acceptable tender to whoever chooses to accept it, like any other piece of property, and its value is determined by how much people want it at any given time.

The only way cryptocurrencies will threaten the legacy financial system is if they remain and thrive outside of it. Let’s play the long game.

Be notified when a new post is up!

Comments

Thank you for this. Good read, just like you explained, this will bring bout more familiarity of the Blockchain technology to Nigerians